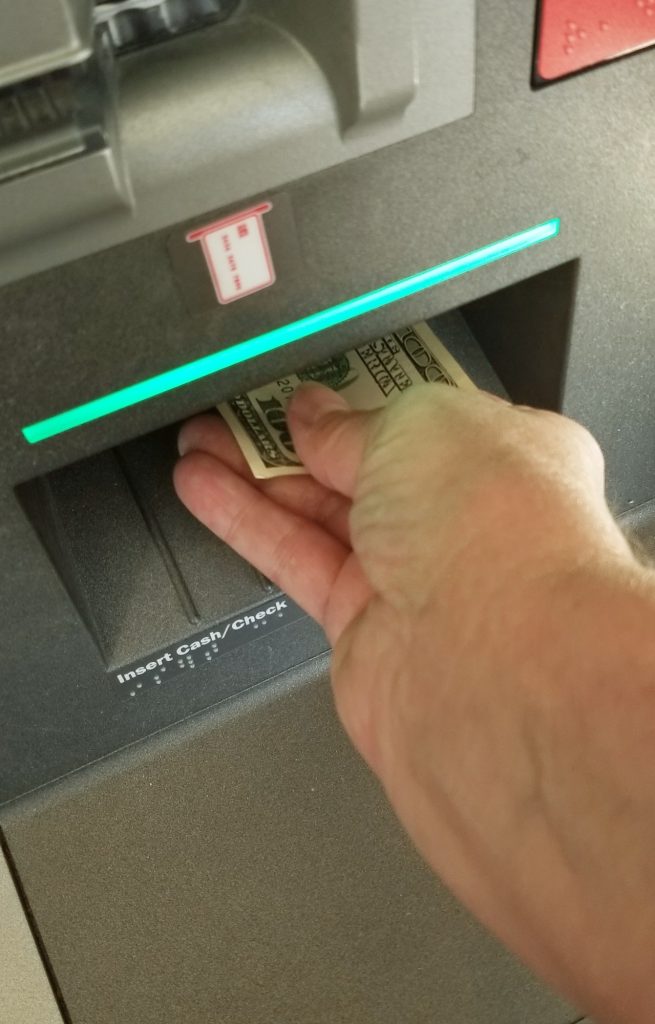

Although the construction industry is highly competitive, there are ample opportunities for expanding your business. Access to appropriate equipment can enable your company to undertake more extensive and more ambitious projects. You can explore various alternatives to ensure that procuring heavy construction equipment doesn’t burden your financial accounts. One such option is known as construction equipment financing. Construction Equipment Financing may be a prudent choice if your company requires additional construction equipment, such as bulldozers, backhoes, graders, dump trucks, excavators, or other types of machinery. Financing enables you to complete the purchase in a matter of days.

Producing a movie or news website is a complex and expensive process. From hiring talent to securing locations, there are many costs involved. Our production financing options can help you cover these costs and ensure that your project stays on track. We offer financing solutions tailored to your specific needs, including short-term loans and lines of credit.

Producing a movie or news website is a complex and expensive process. From hiring talent to securing locations, there are many costs involved. Our production financing options can help you cover these costs and ensure that your project stays on track. We offer financing solutions tailored to your specific needs, including short-term loans and lines of credit.

Although banks may offer marginally lower interest rates, private financing options present compelling reasons to consider them.

Banks typically require a blanket lien on all your company’s assets, while private financing companies only use the equipment purchased as collateral.

Banks have strict requirements and favour companies with impeccable credit. In contrast, financing companies like Alpine Investment Group have greater flexibility in approving loans.

Banks mandate extensive paperwork, whereas private financing companies may offer “Application Only” financing.

The process of obtaining a bank loan can be time-consuming and tiresome. Conversely, securing funding from Dimension takes only a few days after completing a brief online application.

Small and mid-sized contractors who lack the capital to purchase the equipment outright benefit from the flexibility of monthly payments.

Copyright 2023 Alpine Group Funding. All Rights Reserved.